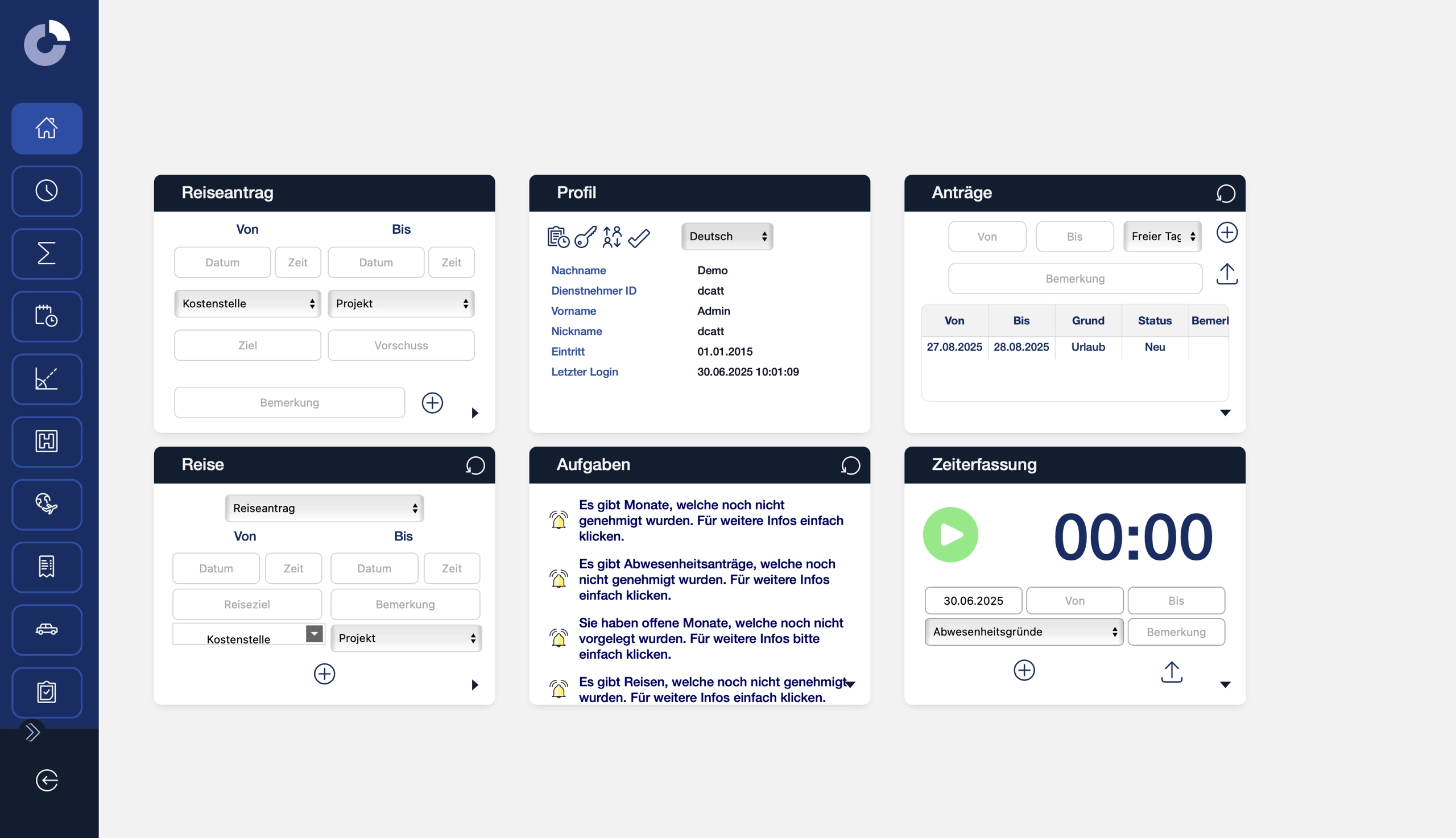

Travelling expenses

Digital travel expense reporting for fast and transparent processing

Your travel expenses under control: Fast, mobile and tax-correct accounting

And much more...

Mileage allowance calculation

Mileage allowances are calculated precisely and can be flexibly adjusted, which allows you to easily and comprehensibly bill the kilometres driven.

Mobile version on the go

With the mobile version, employees can record travel expenses and receipts on the go, which means that settlements can be completed immediately after the trip. Ideal for field workers who want to manage their travel expenses quickly and easily.

Logbook for complete documentation

A digital logbook enables the detailed recording of all journeys, so that business trips and business-related journeys can be documented comprehensively and in a tax-compliant manner.

Tax deferral - secure and legally compliant

Our solution supports tax accrual in accordance with the Income Tax Act (EStG) and collective agreements (KV) to ensure correct, legally compliant accounting.

Travel requests and travel templates

The management and approval of travel requests is facilitated by ready-made and customizable travel templates. This saves time and ensures uniform and structured travel planning.

Cross-industry application

Our expense software adapts to the specific needs of different industries and is ideal for businesses of all sizes – from start-ups to global corporations.

See for yourself!

Start a free demo now – and settle travel expenses quickly, mobile and tax-correct.